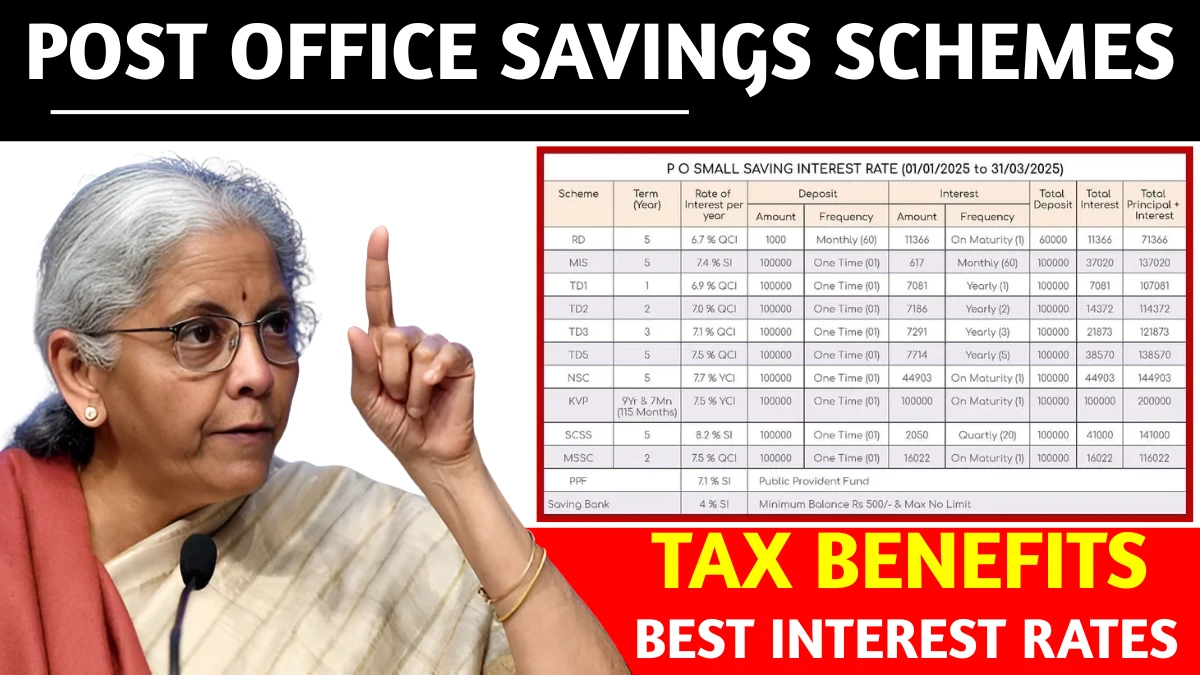

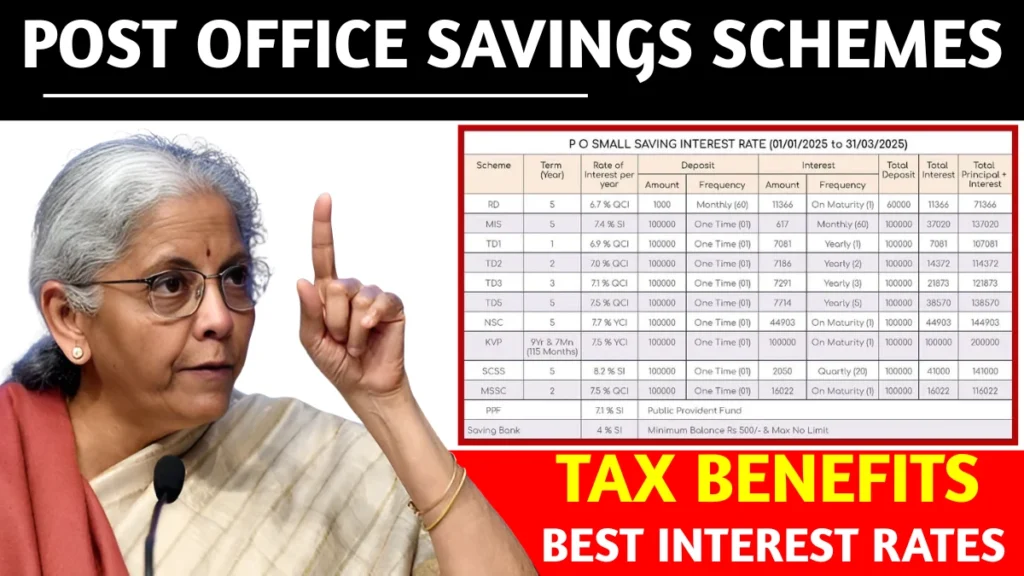

Top Post Office Savings Schemes 2025: The Indian Post Office offers a variety of savings schemes that provide excellent returns and financial security. These schemes are not only reliable but also offer attractive interest rates and several tax benefits, making them ideal for investors looking to secure their future.

In 2025, Post Office savings schemes remain a popular choice for conservative investors due to their low-risk nature and government backing. In this article, we will explore the top Post Office savings schemes of 2025, detailing their interest rates, tax advantages, and other features.

Post Office Fixed Deposit (FD)

The Post Office Fixed Deposit (FD) scheme is one of the safest and most reliable ways to save money in India. Offering guaranteed returns, the scheme has always been a go-to for risk-averse investors. In 2025, the interest rate on Post Office FDs ranges from 5.5% to 6.7% depending on the tenure. This makes it a competitive option for people seeking steady growth without exposing themselves to market risks.

Post Office FDs are available for tenures of 1, 2, 3, and 5 years. These schemes offer the flexibility of monthly, quarterly, or yearly interest payouts. One of the key benefits of investing in a Post Office FD is the safety and security it provides. Since the investment is backed by the Government of India, there is little to no risk of losing the principal amount.

Post Office Fixed Deposits also offer tax advantages under Section 80C of the Income Tax Act, allowing you to claim deductions of up to ₹1.5 lakh annually. However, the interest earned on the FD is taxable, and tax will be deducted at source (TDS) if the interest exceeds ₹40,000 in a financial year.

Post Office Monthly Income Scheme (MIS)

For those who prefer regular income, the Post Office Monthly Income Scheme (MIS) is an excellent option. This scheme is designed to provide a stable source of income with guaranteed monthly payouts. In 2025, the interest rate on Post Office MIS stands at 6.6%, which is higher than many bank savings accounts and other fixed-income options.

The scheme is available for a tenure of 5 years, and investors can opt to receive monthly payments, which is ideal for retirees or people who need a consistent cash flow. One of the standout features of this scheme is the flexibility in the mode of interest payout. The interest is credited to the account every month, ensuring a reliable source of income.

The Post Office MIS scheme also offers a tax benefit. Though the interest earned is taxable, it provides peace of mind for those looking for a secure way to earn regular income. If you are in a higher tax bracket, the interest will be subject to TDS, but it can still be a great option for those looking for low-risk, reliable returns.

Post Office Senior Citizen Savings Scheme (SCSS)

The Post Office Senior Citizen Savings Scheme (SCSS) is specifically designed for individuals above the age of 60. With an interest rate of 7.4% in 2025, it offers one of the highest returns among government-backed savings schemes for seniors. The scheme has a tenure of 5 years, which can be extended for an additional 3 years, providing both short-term and long-term options.

The SCSS offers quarterly interest payments, making it an ideal choice for senior citizens who rely on regular income. The principal amount invested in the SCSS is eligible for tax deductions under Section 80C of the Income Tax Act. However, the interest earned on this scheme is taxable.

One of the key advantages of the Post Office Senior Citizen Savings Scheme is that the investment amount is capped at ₹15 lakh for a single account holder and ₹30 lakh for joint accounts. Given its high-interest rate, this scheme is a top choice for retirees looking to secure their savings while enjoying a decent return.

Post Office Recurring Deposit (RD)

The Post Office Recurring Deposit (RD) scheme is a great option for people who want to build a savings habit. It allows you to invest a fixed amount every month for a specified tenure, with a guaranteed interest rate. In 2025, the interest rate for Post Office RDs stands at 5.8%, making it a competitive option for regular savers.

The minimum deposit in a Post Office RD is ₹100 per month, and the scheme is available for tenures of 5 years. The interest earned on the RD is compounded quarterly, and the investor receives the total amount, including interest, at the end of the tenure. While the scheme does not offer any direct tax benefits, the Post Office RD still provides a reliable, low-risk way to save regularly.

Since the scheme allows for small, manageable monthly deposits, it is a great way to accumulate a corpus over time. The Post Office RD is ideal for people who are looking for consistent growth in their savings, without committing a large sum of money upfront.

Post Office Public Provident Fund (PPF)

The Public Provident Fund (PPF) remains one of the most popular long-term investment schemes in India. Offering a tax-free return, PPF is often considered a cornerstone of any investor’s portfolio. In 2025, the interest rate on PPF is 7.1%, and the investment is compounded annually.

One of the biggest advantages of PPF is its tax benefits. Contributions to PPF are eligible for tax deductions under Section 80C, and the interest earned as well as the maturity proceeds are completely exempt from tax. The scheme has a lock-in period of 15 years, which makes it an ideal option for long-term financial goals such as retirement savings or children’s education.

Though the PPF scheme requires a long-term commitment, it provides the security of guaranteed returns, with the added benefit of tax-free growth. Investors can make yearly or monthly contributions, but the minimum contribution is ₹500, and the maximum is ₹1.5 lakh per year.

Post Office Kisan Vikas Patra (KVP)

The Post Office Kisan Vikas Patra (KVP) is a unique savings scheme that doubles the investment amount in a fixed period of time. In 2025, the interest rate on KVP is 7.5%, and it has a lock-in period of 124 months (approximately 10 years and 4 months). The scheme is available for both individuals and joint accounts, and the minimum investment amount is ₹1,000.

One of the standout features of KVP is its ability to double the investment. This makes it a great option for people looking to grow their savings over a long period. However, like other Post Office savings schemes, the interest earned on KVP is taxable.

Conclusion

In 2025, the Indian Post Office continues to offer some of the best savings schemes available in the country. These schemes provide a perfect balance of safety, competitive returns, and tax benefits, making them an excellent choice for conservative investors. Whether you’re looking for a fixed deposit, regular income, or a long-term investment plan, Post Office savings schemes offer a variety of options to suit your financial needs.

From the Post Office Fixed Deposit to the Public Provident Fund, each scheme has unique advantages and can play an essential role in building a secure financial future. Before making an investment decision, it’s essential to evaluate your financial goals, tax bracket, and risk tolerance. Once you do that, these Post Office savings schemes are bound to help you achieve your financial objectives in 2025 and beyond.

Disclaimer

The information provided in this article is intended for general informational purposes only and should not be construed as financial advice. The interest rates, terms, and conditions mentioned are subject to change and may vary based on government policies and economic conditions. It is recommended that you consult with a certified financial advisor or conduct thorough research before making any investment decisions. The author and the website are not responsible for any losses or damages that may arise from the use of this information. Always verify the latest details from official sources before making any investment.